Tin price hits record highs at $ 35,955 per tonne

Tin continues to be the unexpected star of industrial metals this year. As the broader metals rally shows signs of abating, tin continues to hit new all-time highs in the London and Shanghai markets.

The London Metal Exchange (LME) three-month tin last week hit $ 35,955 per tonne, eclipsing the previous high of $ 33,600 from 2011.

Currently trading around $ 35,400 per tonne, tin is up 68% from the start of the year. Aluminum is far behind with gains of 27% since the start of the year.

LME tin inventories failed to rebuild despite a “super pullback” over time, which saw the premium for cash delivery dip to an unprecedented $ 6,500 per tonne in February .

The gap between cash and three months has since slackened to an offset of “only” $ 480 per tonne, a level that would have been considered scandalous any year other than the current year.

Since the start of the year, the continuing financial crisis has sucked 6,000 tonnes of tin from LME warehouses. The problem is, what happened was just as quickly recovered and reloaded.

Main stocks peaked at 2,415 tonnes at the end of July and have since fallen to 1,730 tonnes, of which only 1,000 tonnes are available.

Out-of-mandate stocks at the end of June stood at just 40 tonnes at Port Klang in Malaysia, according to the latest LME report.

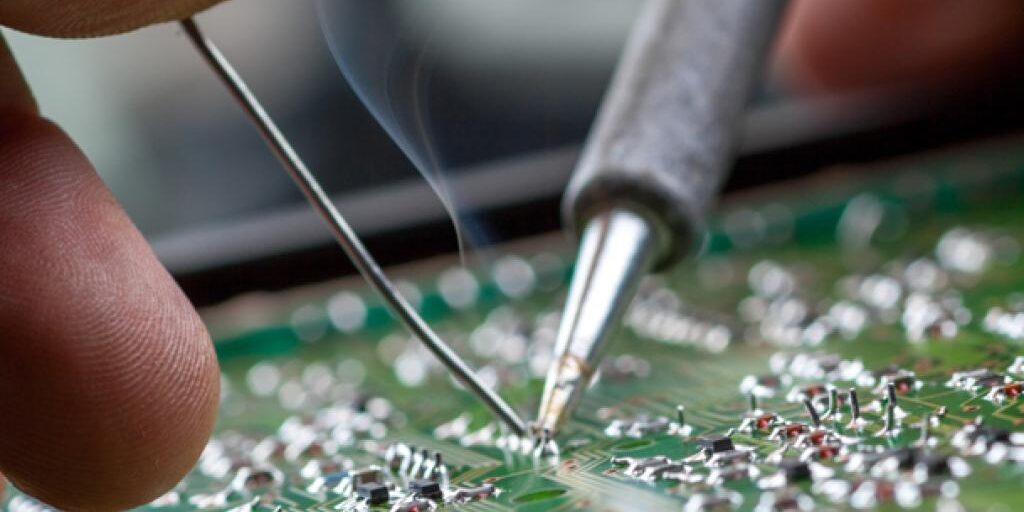

The home appliance sector, the most important for tin in the form of solder in printed circuits, is booming.

Second-quarter semiconductor sales, an indicator of tin solder demand, were up 29% year-on-year and 8% quarter-on-quarter, according to the Semiconductor Industry Association.

Savings are limited given that the welding industry has spent the past 10 years reducing the amount of tin used after the 2011 price spike.

China does not have strategic stocks of tin to sell as it does for copper, aluminum and zinc. The United States does, but has already offloaded its quota of 400 tonnes for the current fiscal year.

South Korea’s government procurement department has some, but the metal is intended for small local consumers.

Only a concerted increase in production is likely to provide lasting relief from the turbulent tin market.

![]()